Indicate the amount of amortization to be charged in each period.Determine the number of periods over which the prepaid amount will be amortized.Record the expense in the reconciliation worksheet used for prepaid expenses.Charge the invoice from the insurance company to the prepaid expenses account.What Are the Accounting Steps to Record Prepaid Insurance? The concept of prepaids is not used in the cash method of accounting, which is most often used by small businesses.

This enables the most accurate reflection of assets in the short term, as well as profit.

When a company uses the accrual method of accounting, the concept of prepaids (including rents, insurance and certain other expenses) allows the accounting process to match the payment for expenses with the periods in which they are actually consumed. In such a case, the portion of insurance prepaid in the prior year and used in the following year is a long-term asset. Rarely, an insurance policy will extend coverage beyond the 12-month accounting period following payment of the initial premium. When the coverage is applied for one month, that amount is expensed on the income statement, and it is no longer shown as an asset. When a business policyholder pays the premium in advance, the total amount is shown as a current asset and is carried as an asset until the coverage is used. This is often the case for health, life, hazard, automotive, liability and other forms of coverage required by a business.

#Prepaid expenses on balance sheet full#

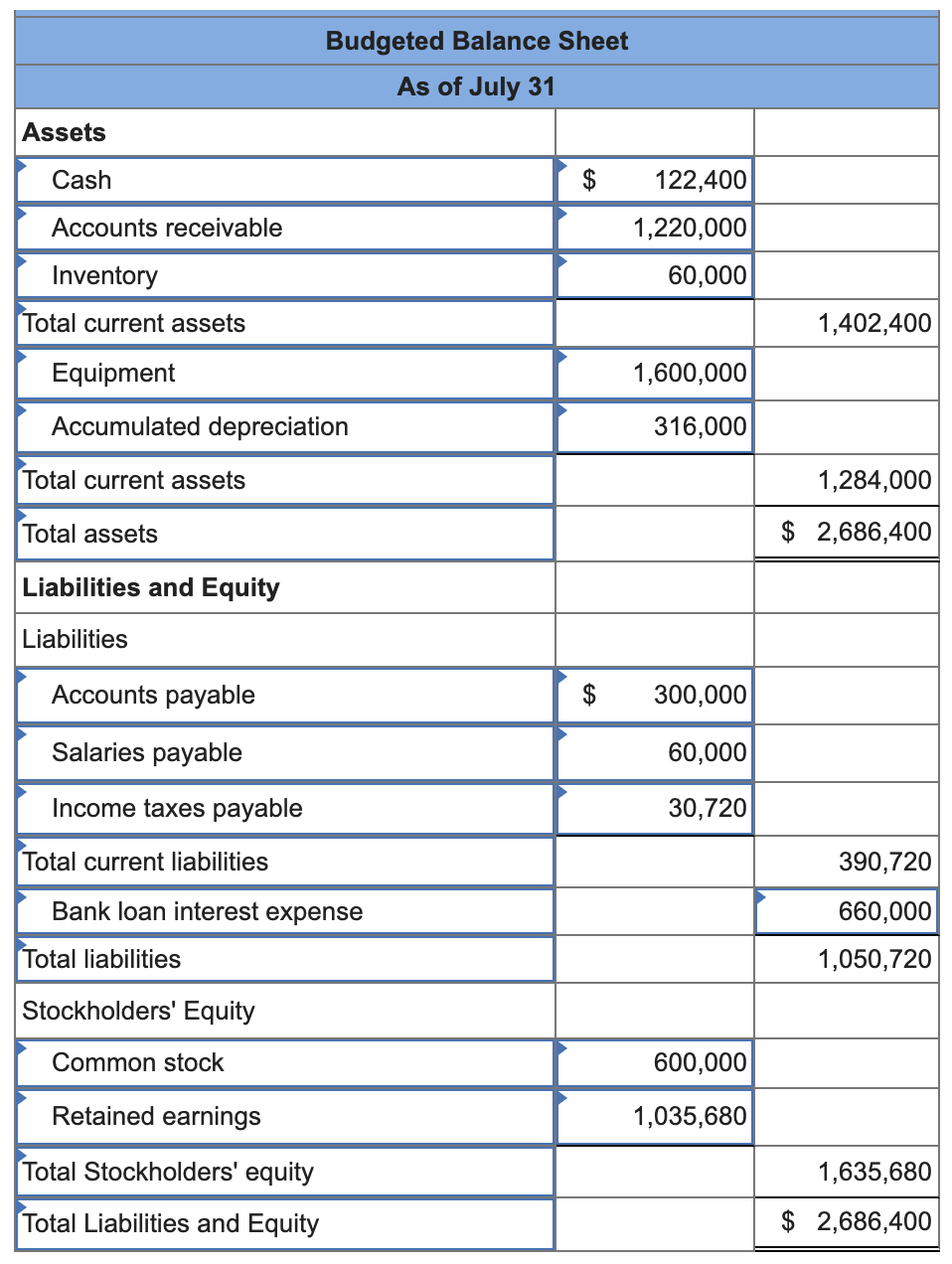

Insurance is typically a prepaid expense, with the full premium paid in advance for a policy that covers the next 12 months of coverage. Current assets, sometimes also referred to as current accounts, are shown on the company’s balance sheet. When an asset is expected to be consumed or used in the company’s regular business operations within the accounting year, it is recorded as a current asset. This includes cash, accounts receivable, inventory, real estate, buildings, equipment, supplies, vehicles – and prepaid expenses, such as insurance premiums and prepaid rent.

Anything that is owned by a company and has a future value that can be measured in money is considered an asset. In a word: Yes, prepaid insurance is an asset.

0 kommentar(er)

0 kommentar(er)